distillery at Singapore Fintech Festival 2023

The Singapore distillery team recently headed down to the 2023 Singapore Fintech Festival. Described as the intersection of Policy, Finance, and Technology, the festival sees more than 66,000 attendees from around the world (over 150 countries!) come together for networking, keynotes and investment pitches.

Here are 5 things we took away from our experience:

This is a big deal, where big deals happen

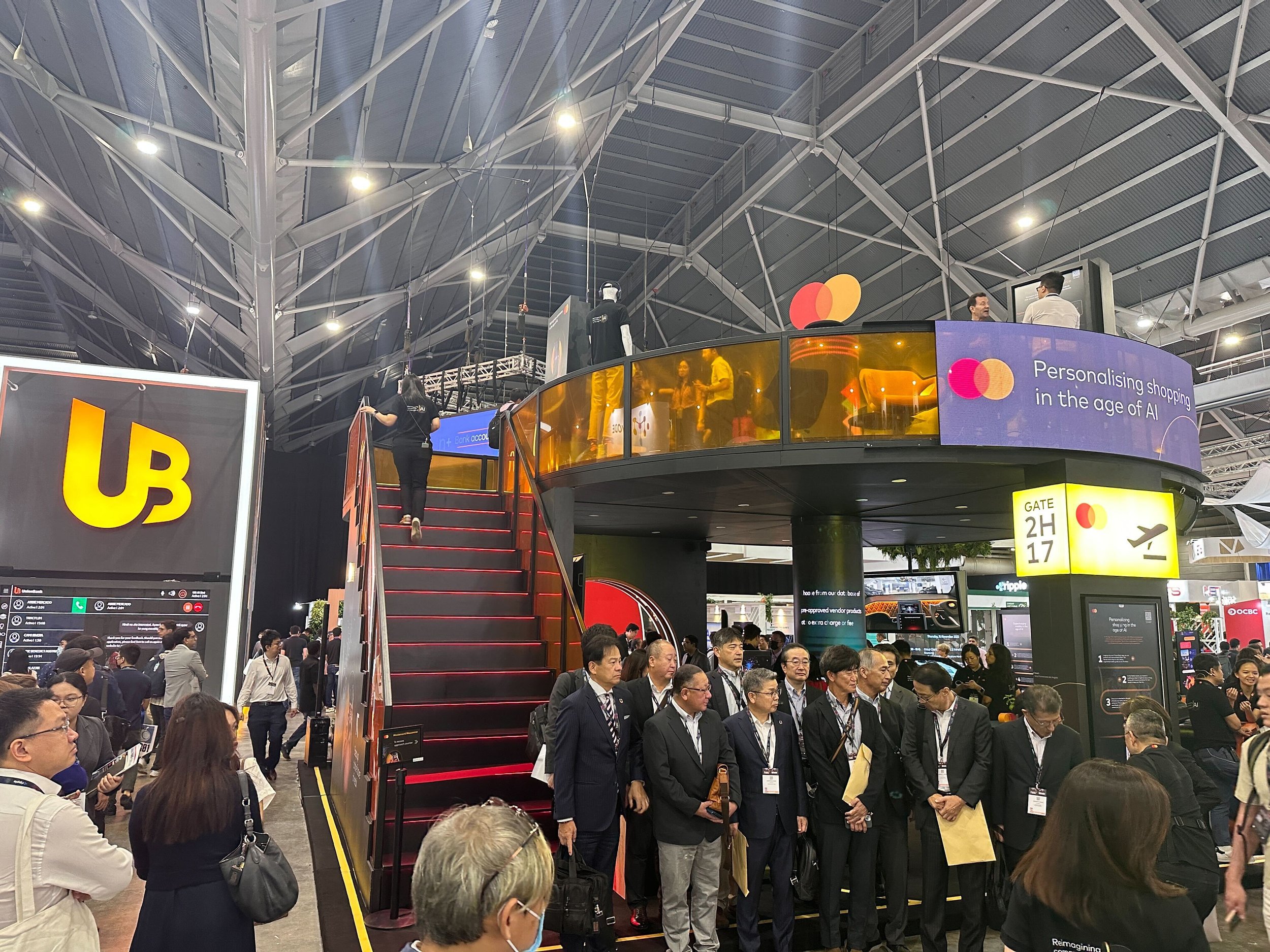

You appreciate the scale of the festival from the moment you walk in, with 5 halls filled with brands, stages and hoards of people flocking from all over Singapore, and the world.

Amongst the more than 700 exhibitors, there were some truly impressive activations and experiences on show. Mastercard with their double story chalet showing off their latest innovations was the standout, but all the big banks and payment platforms didn’t shy away from going big. And it felt like every coffee barista in Singapore had been relocated to Expo as lattes seemed to be the common “giveaway” luring people to every stand.

But beyond this, many brands used the event as a platform to announce major product launches, multi-billion-dollar investments, and huge partnerships. With major publications like CNA, Bloomberg and the FT present, it seemed like an obvious time to make a splash. And no doubt a lot of brands made new connections that will shape the future of Fintech in the very near future.

Special mention to our clients from Ant Group, Currency Cloud and Stripe who were all there with impressive offerings, showing off their latest innovations.

AI was a star of the show

Unsurprisingly, AI was one of the stars of the day. In fact, the theme for the entire event, as discussed by many of the 970+ speakers, was “The Applications of AI in Financial Services”. Almost every brand was showing off their latest and greatest AI-powered solutions, using the narrative in their messaging and displays, or offering a demo of an AI use case at their booth. It really felt like everyone was trying to one up the competition with their AI experience.

There were also 56 sessions at the Technology Zone showcasing advancements in Artificial Intelligence and quantum technologies, as well as their practical applications in e-commerce and payments. This drew quite a crowd, and some incredibly interesting discussions.

Fintech - It’s a tough field to stand out in…

While the variety of organisations and expertise present was vast and diverse, the same couldn’t have been said for some of the branding and messaging. It’s clear walking around that differentiation in these spaces is difficult for brands, with a number of clear conventions when it comes to the visual identity and messaging. So what can fintech businesses do to break out of these norms and stand out from such a buzzing and hectic crowd?

Perhaps a few need to stop using AI tools to write their copy and engage an experienced creative and content company to give them the edge? ;-)

We’re going digital! digital wallets are taking over.

It’s not news that digital wallets are the future of payments - we saw the mainstream rise during the crypto boom a few years ago, and as smartphone usage rises as every generation becomes more tech savvy, traditional payment methods move out of favour. Now there’s many relatively new and unknown “digital wallet” businesses stepping into the frame. Alongside the big banking players in the main hall, we started to see up-and-coming wallets making a firm statement they were on the scene. So how long will it be before physical cards and bank accounts are gone, and we’re all on multi platform digital wallets?

Payments are simple yet saturated -

With such an overwhelming amount to take in from each vendor on display, we learnt there has never been more platforms, more types of solutions and more plugins for retailers to get their head around, but does this make it simpler for the consumer?

It’s clear from walking around that the payments ecosystem is enjoying a boom.But with so much choice, and so much for consumers to get their head around, how easily will we see people switch? Especially to the newer players in the market who don’t have credibility like a 100 year old bank. With ever-present risk of cyber attacks and fraud making trust more relevant than ever in the finance sector, which players will successfully build the presence and trust to go the distance?

All in all, it was an informative and impressive couple of days. The team got to chat to a wide spectrum of businesses, from household names in banking and global fintech success stories, to local and international startups. Similar challenges they were facing emerged and we’re excited to help a number of them look at the ways they communicate their offering and engage their audiences in the future.

If you’re trying to break through the noise in the fintech space, get in touch.